Investment in core plus and non-core infrastructure: Strategic shift in focus of private equity firms

Social Bonds : A significant financing opportunity amid the pandemic

- Investment in core plus and non-core infrastructure: Strategic shift in focus of private equity firms

- Infrastructure investments in renewable energy and nascent clean technologies (including HVAC) is gaining momentum

- Support of PE infrastructure funds for non-core digital assets is growing

- Other non-conventional sectors are also attracting capital from PE infrastructure funds

- Momentum in non-conventional-infrastructure investment is likely to continue

- How Acuity Knowledge Partners can help

Investment in core plus and non-core infrastructure: Strategic shift in focus of private equity firms

In recent years, infrastructure-focused private equity (PE) firms, such as Blackstone, Stonepeak, EQT, KKR and Macquarie, have increasingly turned their attention to non-core infrastructure or soft infrastructure. They are targeting assets including energy as a service (EaaS), electric vehicle (EV) supply chains, data centres, semiconductors, healthcare real estate especially in Asia Pacific (APAC) and equipment as a service. These assets are considered riskier than conventional core and core plus infrastructure assets but may offer higher returns.

Conventional core assets – airports, bridges, tunnels, roads, energy plants, towers and fibre cables – are essential assets, known to have no operational risk, and are typically already generating returns. Core plus assets – data centres, waste treatment plants, hospitals, schools and warehouses – react more to economic shifts and demand changes. Non-core assets top both in risk.

PE firms are increasingly investing in core plus and non-core infrastructure assets for bigger profit, diversification and improved operational performance, especially as traditional ‘core’ infrastructure options become more saturated. These assets, marked by stable returns, high barriers to entry and positive social impact, meet the general investment criteria of PE infrastructure firms.

2022-2024 investment trends

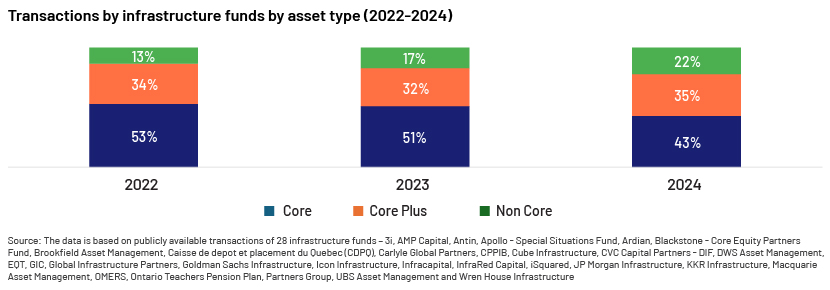

In our analysis of the 28 large infrastructure PE funds on the basis of publicly available information, the share of core plus and non-core infrastructure investments has been increasing since 2023, currently accounting for above 50% of PE-infrastructure-fund deals.

Infrastructure investments in renewable energy and nascent clean technologies (including HVAC) is gaining momentum

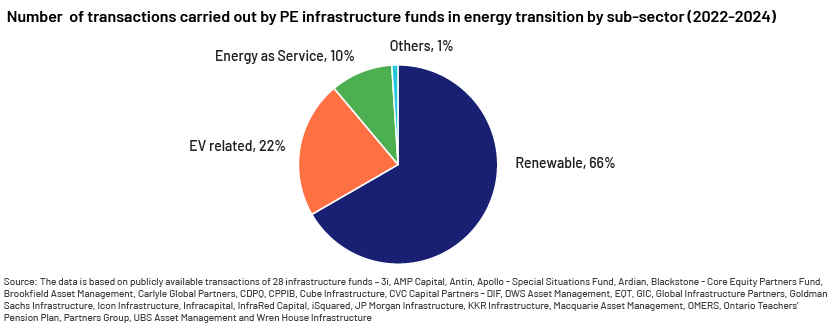

In recent years, the infrastructure investment landscape has undergone a significant transformation, with a marked increase in transactions within the overall renewable energy and clean energy sectors. Investments in EV (core plus) and EaaS (non-core) have constituted almost one-third of the total number of investments over 2022-2024. A combination of environmental, economic and technological factors has led to a surge in investments not only in traditional renewable energy projects but also in subordinate sectors such as battery energy storage systems, EaaS, EVs, heat pumps and heating, ventilation and cooling (HVAC) systems. This trend is expected to continue as countries strive to meet their net-zero emission targets. Let’s discuss these trends in detail.

Rising investment in EV infrastructure and its supply chain

Falling battery costs and rising renewable energy demand have boosted investments in EV infrastructure and batteries and their supply chain

In 2024, Antin Infrastructure invested in Power Dot – a public EV destination charging infrastructure

In 2023, Infracapital invested in Zenobe Energy – an operator of battery storage grids

- In 2022, DIF invested in Bump – an operator and installer of EV charging stations

As more countries set ambitious carbon-reduction goals, demand for reliable and widespread charging infrastructure is expected to grow.[2]

EaaS is catching investor attention

Investments in smart metering, EaaS and HVAC solutions is gaining traction, as these assets are associated with steady cash flow and long-term contracts.[3] The development of low-emission infrastructure and efficient redeployment of old infrastructure assets call for significant capital. S&P Global believes energy transition investment has to scale up three times the current level to USD5tn per year over 2023-2050 to meet the Paris Agreement objective, opening the gate for private participation (including PE infrastructure players), as governments alone cannot meet the steep funding requirement.[4]

In 2024, EQT and GIC invested in Calisen – a UK-based provider of smart meters and heat pump installation services, among others

In 2024, Partners Group purchased Eteck – a leader in heating and cooling solutions in the Netherlands[5]

As sustainability and the digitalisation of utilities gain traction worldwide, this sector is likely to be a key area of interest for investors.

Increasing interest in nascent green technology

Within renewables, nascent clean energy companies, such as clean hydrogen production and carbon capture companies, have also seen some interest from PE infrastructure funds. We discuss a few examples below

--Hy24 – a joint venture between Ardian and FiveT Hydrogen – operates as an asset management company, investing in large-scale infrastructure projects for the production, storage and distribution of clean hydrogen. Furthermore:

Hy24 has been investing in related companies. Since its announcement in October 2021, it has invested more than USD2.4bn in c.10 related assets (until February 2025) including producers of renewable gases, operators of hydrogen stations, hydrogen storage system providers and a hydrogen power vehicle developer

Blackstone, in 2023, announced a JV for Occidental Petroleum Corporation’s direct air capture facility located in West Texas

While the last few years have seen an increase in investment in nascent technologies, investment may decelerate in the sector in the future, as these not-yet-profitable technologies entail high risks and costs.

Support of PE infrastructure funds for non-core digital assets is growing

The telecommunication sector has always been a significant area of interest for PE infrastructure funds, due to its essential role in modern communication. The scope of investment in this space is expanding beyond traditional telecommunication infrastructure to include data centres and supporting sectors, driven by a surge in data consumption and the need for robust digital infrastructure.

Continued momentum in data centre investment

PE infrastructure funds are increasingly investing in data centres because of the soaring demand driven by the artificial intelligence (AI) boom and cloud service expansion. Data centre projects provide predictable returns through long-term leases (typically 5-20 years), with hyperscalers often committing to 10- to 15-year leases. Stable long-term cash flow from high-quality tenants (such as major technology companies), together with high demand for data storage and processing, make this market more appealing than traditional real estate or infrastructure investments.

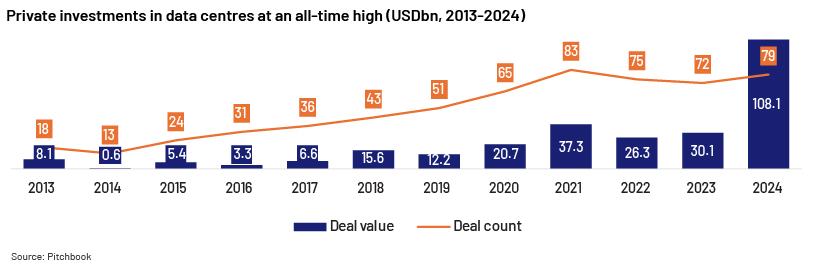

In 2024, digital infrastructure funds invested a record USD108.1bn in data centres and related markets, representing year-over-year (y/y) growth of over 200% , owing to a spike in spending on generative AI (GenAI) by corporate giants such as Microsoft, Amazon and Meta. , , The average deal size in 2024 increased to USD1.4bn from USD0.4bn in 2023, growing 250% y/y, with the dominant mega deals being Blackstone’s acquisition of AirTrunk for USD16bn and DigitalBridge’s USD9.2bn investment. The top 10 PE data centre deals cumulatively totalled USD36bn in 2024.

In November 2024, the Canada Pension Plan Investment Board (CPPIB) supported a project worth 1tn won (c.USD686m) to develop data centres in South Korea

In October 2024, the CPPIB teamed up with Singapore’s GIC and Equinix to invest over USD15bn in US data centre development

In September 2024, Microsoft, BlackRock, MGX and Global Infrastructure Partners announced the Global AI Infrastructure Investment Partnership, seeking to pump money in new and expanded data centres, as well as energy infrastructure to support these facilities

Demand for data centre capacity to support AI, cloud computing and data storage services is likely to intensify in 2025 , leading to more investments by PE infrastructure companies in this space.

Semiconductor companies are now being considered infrastructure companies

This shift highlights the semiconductor industry’s importance in supporting technological advancements. For 15 years, PE infrastructure funds avoided semiconductor companies, due to the perceived cyclical demand, as well as high capital requirement and research and development (R&D) costs. However, recent supply chain shortages, US government subsidies through the CHIPS Act and demand shifts have made semiconductors more appealing to PE investors. Consequently, PE investments in semiconductor companies and their value chains have increased.

One of the key drivers of this growth is the automotive and industrial sectors, which are being propelled by internet of things and GenAI. Despite making up less than 20% of the market by xxxx, these sectors offer stable demand, longer product life cycles, lower R&D needs and a less concentrated supply chain.

In 2024, GIC acquired Japan-based Sumitomo Bakelite, which develops, produces and sells life and plastic products and semiconductor materials worldwide

In 2022, Brookfield Infrastructure Partners agreed to invest USD30bn in Intel’s Chandler (Arizona) semiconductor fabrication plant

Other non-conventional sectors are also attracting capital from PE infrastructure funds

Sectors that have typically been off the radar of PE infrastructure funds have caught their attention. Favourable demographics of developing countries and innovative business models owing to changes in regulations and technology simultaneously seem to have led to a change in heart among PE investors.

Rise in interest in healthcare sector in APAC

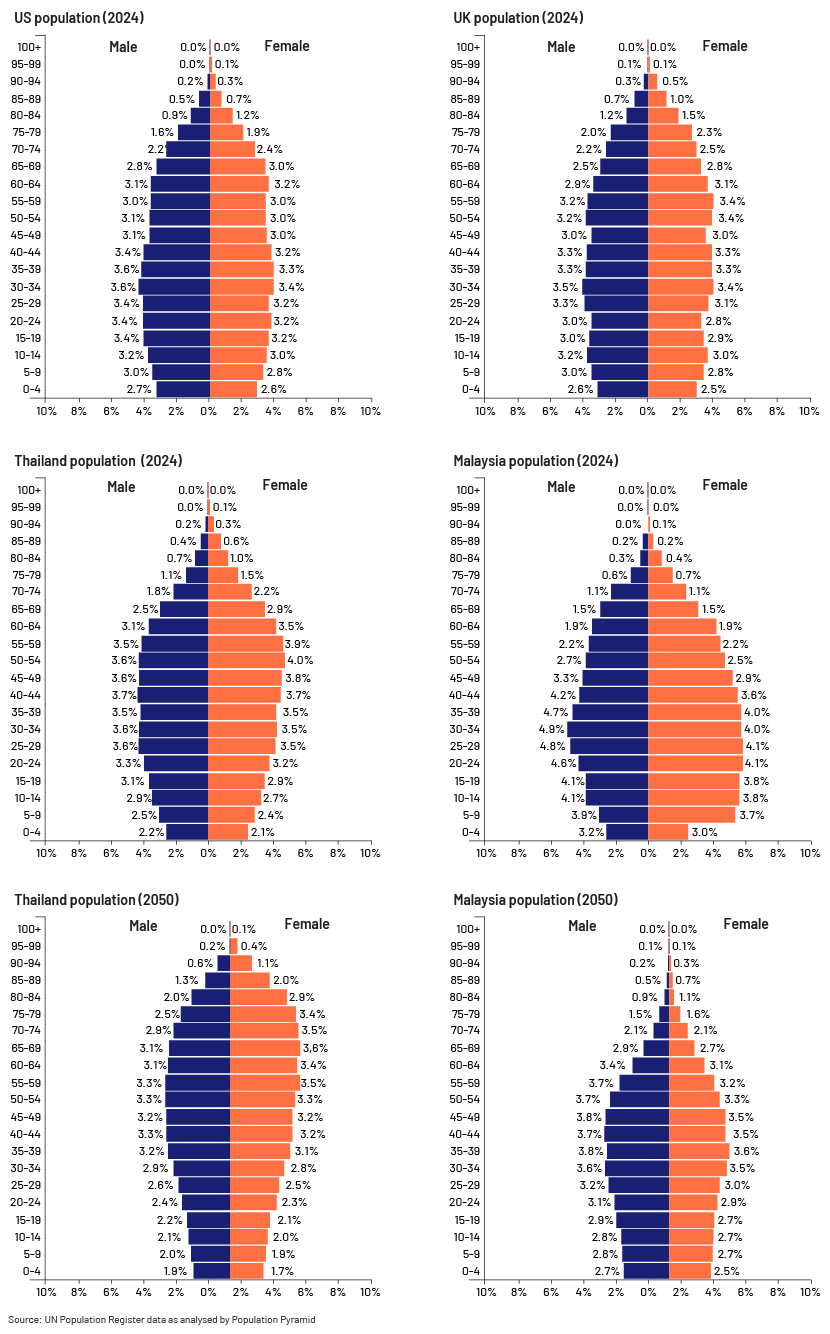

Hospitals and other healthcare service providers have piqued the curiosity of PE infrastructure funds, which had primarily concentrated on developed regions such as the Americas and Europe. In the last five years, these funds have shown growing interest in healthcare deals in APAC driven by demographic changes and increasing healthcare needs in the region. By 2050, those aged 60 or more are expected to grow nearly two-fold (vs 2020) in developing Asia and the Pacific to 1.2bn (source: Asian Development Bank), multiplying the healthcare services required.

For instance, in 2050, the UN believes Asian countries (such as Thailand and Malaysia) will have age demographics similar to those of developed economies such as the US and the UK.

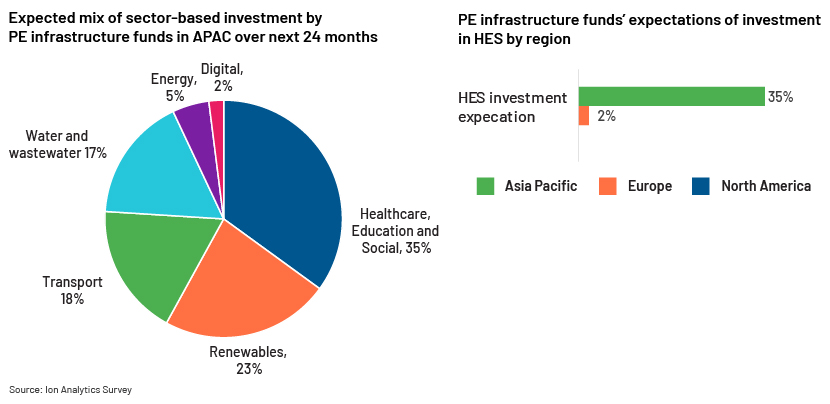

According to a 2024 survey conducted by DLA Piper (global law firm), over 35% of global respondents anticipated APAC to see the most infrastructure investment in the health-education-social (HES) sub-sectors over the next 24 months, surpassing renewables (23%). In contrast, only 2% foresaw HES investment in Europe outpacing other sectors, while none expected this in North America.

This trend is influenced by several factors, including the strong focus on energy and digital projects in developed markets, where the need for HES upgrades is less urgent. Additionally, many HES assets in these regions are already well established, publicly funded or under long-term contracts, limiting new private investment opportunities.

Beyond hospitals, PE infrastructure funds are seeking to invest in senior citizen homes including retirement villages and nursing homes in the developed markets in APAC such as Singapore, Japan, Australia and New Zealand. An ageing population and increasing incidence of chronic diseases, coupled with burgeoning paying capacity of people in APAC, are likely to drive investment further in this sector.

In 2024, Stonepeak invested in Arvida Group – owner and operator of retirement villages in New Zealand

EQT invested in two similar companies – Levande and Stockland Retirement – in Australia in 2023

Increasing keenness to invest in equipment as a service

Similar to EaaS, the equipment rental market, also called equipment as a service, has attracted material attention, as after the COVID-19 pandemic, companies have been shifting their focus from capital expenditure (capex) to operational expenditure, allowing them to manage cash flow better and avoid large up-front costs. Equipment as a service not only reduces capex, but also improves operational flexibility, lowers environmental damage and enables access to the latest equipment technology, especially in a challenging interest rate environment. Hence, companies are increasing investment in equipment as a service or rental/leasing companies in multiple sectors, including core-plus (e.g., logistics) and non-core (e.g., aerospace and construction).

According to Equipment Leasing and Finance Association, the estimated 2024-2030 c.50% EaaS CAGR will likely induce more businesses in developed regions to deploy the subscription-based-equipment model, making the sector more lucrative for investors. Regionally, revenue from equipment rental will edge up 5.7% y/y in 2025 in the US (source: the American Rental Association), whereas this revenue will advance 7.6% y/y to USD8.2bn in 2024 in Canada (source: the Canadian Rental Association).

Transactions in the non-core aerospace sector gained traction in 2024 owing to increasing demand for air services, primarily driven by ecommerce and passenger traffic (IATA expects passenger journeys will double to 7.8bn by 2040 [vs 2019]) .

In 2024, CVC DIF acquired and bundled three companies – S-P-S International (specialist in non-motorised equipment, with operations in Europe and Benelux) and CTC Moyson Airport Equipment (specialist in motorised ground equipment, serving the Belgian and Western European markets), which are part of HiSERV (German ground service equipment specialist), leading the way in leasing ground equipment for aviation in Europe

In 2024, Stonepeak acquired Air Transport Services Group, Inc. – a freighter aircraft leasing company – as the latter had deep relationships with the biggest ecommerce firms and integrators in the world

Beyond aerospace, we have seen investments in equipment rental in industries that had not been typically considered infrastructure assets, such as portable construction equipment, vessels and containers, and pallets in freight forwarding, especially in Asia.

In 2024, Antin Infrastructure Partners invested in GTL Leasing LLC, which offers leasing services for composite cylinder-based gas transports, and in Portakabin Limited – a designer, manufacturer, seller and hirer of modular and portable steel-framed buildings

In 2023, CVC DIF invested in Fjord1 AS, which together with its subsidiaries, operates electrified passenger ferries and other passenger boats in Norway, using a concession-based model

In 2023, Stonepeak invested in Textainer Group – a company that leases its fleet of intermodal containers worldwide

In 2023, KKR invested in India-based Leap India

In 2022, in pallet pooling in Asia, Goldman Sachs invested in Singapore-based Goodpack

Increasing consideration of real estate as infrastructure

The lines are blurring between infrastructure and real estate funds. In 2025, KKR announced it would combine infrastructure and real estate funds under a single leader. Investments in schools and commercial properties including retail, car parks, student accommodations and office buildings are also witnessing rising interest from PE infrastructure funds, largely to capitalise on infrastructure’s lucrative returns while stabilising real estate performance. This strategy aims to optimise asset synergies and leverage enhanced returns in the face of fluctuating economic conditions.

In 2024, leading Australian property fund manager ISPT joined IFM Investors, a global asset management company, creating a USD240bn+ fund to provide more clout and more choice to its investors, globally and locally

In 2022, Macquire Asset Management acquired an office building in Milan

In 2022, GIC invested in West Village in Australia – a realty urban regeneration project focused on retail plus hospitality, wellness, parking and office space

In 2022, UBS Asset Management acquired DIY Retail Park in the UK, while iCon Infrastructure invested in Ski Resorts in Sestriere in Italy

Real estate is expected to track the growth in infrastructure investment since they are interlinked (infrastructure development brings businesses and workers, resulting in offices, houses, shops, etc.).

Momentum in non-conventional-infrastructure investment is likely to continue

The growing momentum behind data centres and decarbonisation assets is poised to persist, as evolving macroeconomic conditions and policy shifts create new opportunities for investment. These subsectors, underpinned by robust fundamentals, have demonstrated resilience amid recent capital market volatility.

Investment opportunities are expected to be shaped by increasing consumer and government demand for energy-efficient solutions, alongside emerging prospects in repurposing existing assets. This convergence is likely to catalyse innovative business models tailored to the evolving needs of expanding economies.

Furthermore, the strategic emphasis by nations on onshoring critical industries, particularly semiconductors, and strengthening supply chains is anticipated to significantly influence private equity infrastructure firms’ investment strategies.

Overall, investors are increasingly exploring non-traditional infrastructure assets, including real estate, provided they deliver strong risk-adjusted returns across market cycles and macroeconomic conditions. Such assets offer the potential to enhance portfolio diversification, serve as an effective hedge against inflation and mitigate downside risks, positioning them as compelling additions to investment portfolios.[35]

How Acuity Knowledge Partners can help

We help PE funds throughout their investment value chain, including industry research, deal screening and due diligence, deal acquisition and portfolio monitoring, empowering them to fast-track their investment decisions. Our integrated solutions across asset classes and functions help asset managers improve investment performance, enhance client servicing, attract new client assets and retain assets in the current complex business environment. By partnering with us, our clients have achieved cost savings of 50-60% versus performing these functions in-house.